How the high-profile trial of the music mogul offers lessons for entrepreneurs on accountability, ethics, and leadership.

Updated

January 8, 2026 6:35 PM

Sean "DIddy" Combs. PHOTO: NPC NEWS

Sean “Diddy” Combs—hip-hop icon, entrepreneur, and cultural force—has built a career on his larger-than-life persona, business acumen, and ability to dominate industries ranging from music to fashion to spirits. But his recent trial, which involves explosive allegations of racketeering, sex trafficking, and transportation to engage in prostitution, has cast a shadow over his legacy.

The federal trial, which began after his arrest in September 2024, has revealed shocking claims, including coercion, manipulation, and the abuse of power in both personal and professional settings. While Combs has pleaded not guilty to all charges, the case offers valuable lessons for small business owners about leadership, ethics, and the responsibility that comes with power.

Here’s what entrepreneurs can learn from the allegations and fallout surrounding Diddy’s trial.

Diddy has been accused of creating a toxic environment that involved coercion, manipulation, and abuse of power—both in his personal relationships and his professional dealings. The trial has highlighted allegations of “freak-offs,” elaborate sexual encounters with escorts that were reportedly coerced, as well as threats of financial and reputational harm to control others.

In business, leaders hold significant power over employees, partners, and collaborators. whether through coercion, intimidation, or favoritism—can lead to toxic environments and long-term damage to the organization.

The case has shown how Diddy’s alleged actions went unchecked for years, with accusations of violence, threats, and even financial control over his accusers. Testimonies from former employees and partners reveal a pattern of behavior that created a culture of fear and silence around him.

For small business owners, this is a reminder that accountability begins with leadership. If you fail to hold yourself and others accountable, you risk fostering an environment where misconduct is ignored or accepted.

A recurring theme in the trial is how Combs’ personal actions—both alleged and confirmed—have affected his professional reputation. From footage of him physically assaulting Cassie in a hotel hallway to allegations of coercion during drug-fueled parties, the courtroom revelations have tarnished his public image and cast a shadow over his brand.

For small business owners, this reinforces an important truth: your personal behavior can have far-reaching consequences for your business. Customers, employees, and partners often associate the values and reputation of a business with its leader.

The case has also highlighted the dangers of power imbalances. Testimonies from accusers like Cassie allege that Diddy used financial control—such as threatening to withhold rent payments—to coerce others into complying with his demands.

In a small business setting, power dynamics are also present, particularly between employers and employees or business owners and partners. Misusing that power, even unintentionally, can lead to resentment, distrust, and legal challenges.

The allegations against Diddy span more than a decade, with claims of abuse dating back decades. Had there been systems in place to address grievances or hold him accountable earlier, the damage to his brand—and to the individuals involved—might have been mitigated.

For small businesses, neglecting proactive measures to address workplace issues can lead to larger crises later. Waiting until problems escalate is not only costly but can also permanently harm your business’s reputation.

The Sean “Diddy” Combs trial is a cautionary tale about the consequences of unchecked power, unethical behavior, and a lack of accountability. For small business owners, it underscores the importance of leadership that prioritizes transparency, fairness, and integrity.

Running a business isn’t just about profits—it’s about creating a legacy founded on trust and respect. By learning from the mistakes and controversies of others, entrepreneurs can build companies that inspire loyalty, foster positive relationships, and stand the test of time.

Keep Reading

How a Korean biotech startup is using AI to move drug discovery from trial-and-error to precision design

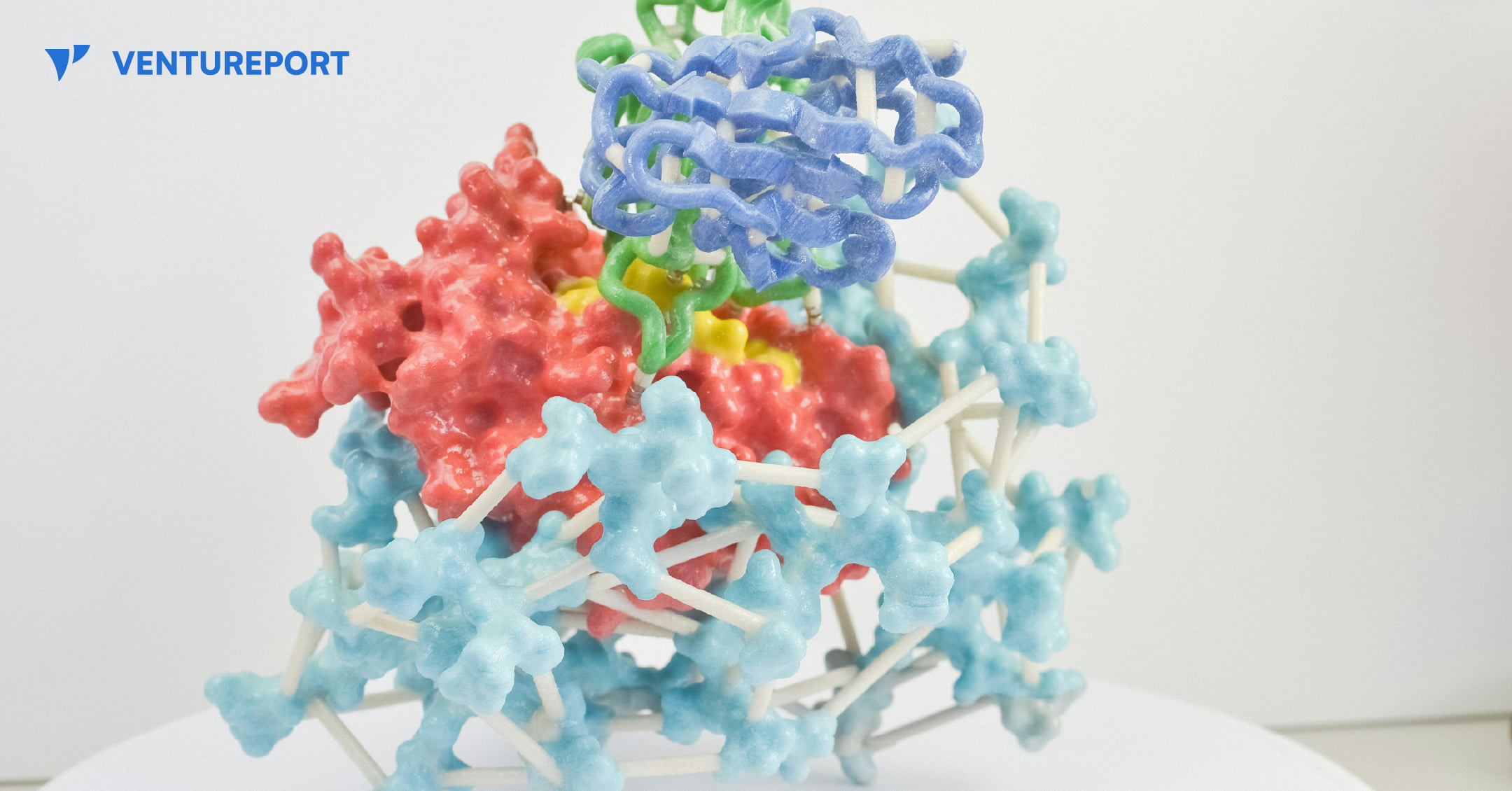

A close up of a protein structure model. PHOTO: UNSPLASH

For decades, drug discovery has relied on trial and error, with scientists testing thousands of molecules to find one that works. Galux, a South Korean biotech startup, is changing that by using AI to design proteins from scratch. This method, called “de novo” design, makes it possible to build precise new therapies instead of searching through existing ones.

The company recently announced a US$29 million Series B funding round, bringing its total capital to US$47 million.This significant investment attracted a substantial roster of institutional backers, including the Korea Development Bank (KDB), Yuanta Investment, SL Investment and NCORE Ventures. These firms joined existing investors such as InterVest, DAYLI Partners and PATHWAY Investment, as well as new participants including SneakPeek Investments, Korea Investment & Securities and Mirae Asset Securities.

At the core of the company’s work is a platform called GaluxDesign. Unlike many AI tools that only predict how existing proteins fold, this system uses deep learning and physics to create entirely new therapeutic antibodies. This “from scratch” approach lets the team go after so-called “undruggable” proteins. These are targets that traditional small-molecule drugs can’t reach because they lack clear binding pockets. By designing proteins to fit these complex shapes, Galux aims to unlock treatments that have stayed out of reach for decades. And that’s exactly why investors are paying attention.

The pharmaceutical industry is actively looking for faster and more efficient ways to develop new drugs, and Galux is built for exactly that. The company connects its AI platform directly to its own wet lab, where designs can be tested in real time. Each result feeds straight back into the system, sharpening the next round of models. This continuous loop speeds up discovery and improves precision at every step. It’s also why partners like Celltrion, LG Chem and Boehringer Ingelheim are already working with Galux.

Galux is no longer just trying to make drugs that stick to a target. The company now wants its AI to design medicines that actually work in the body and can be made at scale. In simple terms, a drug has to do more than bind to a disease—it must be stable, safe and strong enough to change how the illness behaves. Galux is moving into tougher targets such as ion channels and GPCRs. These play key roles in heart function and sensory signals. Ultimately, the goal is to show that AI-driven design can turn complex biology into real treatments. And instead of hunting blindly for a solution, the team is building exactly what they need.